Table of Contents

Principle of Public Finance:

The phrase “Principle of Public Finance” means the fundamental rule, which should determine the financial policy of the State. This fundamental rule is known as the principle of maximum social advantage or maximum net-social advantage of maximum social welfare. Prof. Pigou and subsequently Dr. Dalton are the two prominent economists, who are credited for formulating and popularizing this principle of public finance.

Classical economists like Adam Smith believed in a minimum of State activities and taxation. Following Adam Smith, J. B. Say, the French disciple of Adam Smith, stated, “The very best of all plans of finance is to spend little and the best of all taxes is that which is least in amount.” Adam Smith and Ricardo believed that private expenditure is “productive” and State expenditure is “unproductive”. It is here that these economists remarked, “every tax is an evil” and “every public expenditure is unproductive”. Contrary to this, Prof. Dalton rightly observed, “It is not true that every tax is an evil.” For example, taxes on narcotic drugs, alcohol, and other intoxicants reduce consumption of such commodities which are injurious to health and thus may be a positive good to the society. Again he supported public expenditure and was opposed to the classical view that it is unproductive. “Credulous minds are thus biased in advance against all forms of public expenditure. We might, just plausibly, start from the assertion that all public expenditure is good”. For Example- the State expenditure on agriculture, industries, public health, education, justice, etc., cannot be regarded as unproductive, as such expenditure increases economic and social welfare in one way or the other. At the same time, Prof. Dalton was of the view, “It is not true that all public expenditure is good. Expenditure, on unnecessary wars is an obvious evil.” It is now obvious that the contention of classical economists, that every tax is an evil and every public expenditure is unproductive, has long been discredited by the modern economists. They believe that the economic test of the productiveness of any expenditure is its productiveness of economic welfare. For example- public expenditure on education and health is often more productive than private expenditure on luxuries. Hence, if an operation of public finance enhances the economic welfare of the society as a whole, it may be considered desirable, otherwise not.

The Principle of Maximum Social Advantage:

Let us now discuss the principle of public finance which should govern the operation of public finance to maximize the economic welfare of society as a whole. Public revenue and public expenditure are two important financial operations of a State. These two financial operations of the State must be governed by some fundamental principles, so that they may result in maximum social benefit. Prof. Pigou and Prof. Dalton were the two prominent economists, who were responsible for formulating and popularising this fundamental principle of public finance.

The principle says that the State should collect revenue and spend the money so as to maximize the welfare of the people. When the state imposed taxes, some disutility is created. On the other hand, when the state spends the money, there is some gain in utility. The state should so adjust the revenue and expenditure so that the surplus of utility is maximized and disutility is minimized. It should be noted here that the individual welfare of all the people cannot be maximized, if the welfare of some may even decrease; but if the welfare of the large majority of the people increases, the net welfare of the society as a whole would be greater. To state it in the words of Prof. Dalton- As a result of these operations of public finance, changes take place in the amount and in the nature of wealth which is produced, and in the distribution of that wealth among individuals and classes. Are these changes in their aggregate effects socially advantageous? If so, the operations are justified, if not, not. The best system of Public Finance is that which secures the maximum social advantage from the operations, which it conducts, Prof. Dalton, called this principle as the principle of Maximum Social advantage and Prof. Pigou called it as the principle of Maximum Aggregate Welfare.

Extent of Public Revenue and Expenditure:

Prof. Dalton also pointed out the manner and extent of public expenditure and revenue in which it should be incurred and collected. To put in the words of Prof. Dalton, Public Expenditure in every direction should be carried just so far, that the advantage to the community of a further small increase in any direction is just counterbalanced by the disadvantage of a corresponding small increase in taxation or in receipts from any other source of public income, “This gives the ideal total both of public expenditure and public income.” This will mean that with every additional unit of tax raised, the burden of sacrifice will go on increasing and the amount of benefit will go on decreasing. Thus, a point will be reached where the benefit derived from a unit of money spent by the State will be just equal to the sacrifice imposed in raising that unit of revenue. Here the State should stop, as at this point the marginal sacrifice is equal to the marginal benefit. This is the optimum limit of the State’s public finance activity. Thus, Public Expenditure should be incurred upto the point where the marginal utility due to public expenditure, is just equal to the marginal disutility due to the taxation of public income.

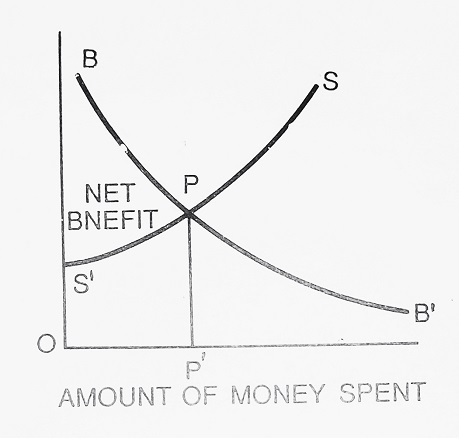

This has also been explained with the help of the above diagram, in which SS’ represents the sacrifice or disutility curve and BB’ represents the benefit curve or utility curve. Both these curves intersect at the point P. OX axis represents the amount of money spent and the OY axis represents the sacrifice involved or the benefit received by the amount spent.

The area covered under the benefit curve (BB’) minus the area covered under the sacrifice curve (SS’) represents the net benefit gained, on account of OP’ expenditure. OP’ expenditure is optimum at point P as the utility gained by the last unit of money is equal to the utility lost by the last unit of money at this point. The sacrifice curve (SS’) is a rising curve as the sacrifice goes on increasing with every additional unit of money raised for the purpose of public expenditure, while on the other hand benefit curve (BB’) will be a falling curve since the benefit per unit decreases as the expenditure increases. The point (P) where both curves meet shows the optimum limit of the State’s financial activity. It is the point where the marginal sacrifice made as a result of taxation is equal to the marginal benefit gained as a result of public expenditure.

Distribution of Resources:

The resources should be so distributed among different users that the marginal return of satisfaction is the same for all of them, i.e., the expenditure be distributed between battleships and Poor Relief in such wise that the last shilling devoted to each of them yields the same return of satisfaction. It is the principle of Equimarginal utility or maximum satisfaction as applied to public finance. Again, suppose that the marginal utility of expenditure on agriculture is greater than on defence, i.e., the expenditure on agriculture would result in greater satisfaction than that defence. Hence, the resources should be transferred from defence to agriculture, and such transfer should continue till the marginal utilities in both directions are the same.

Distribution of Burden of Taxation:

Prof. Pigou advocated that the burden of taxation on different sources should be distributed according to the principle of least aggregate sacrifice, i.e., that the burden of taxation should be so distributed on different sources that the marginal sacrifice of each source is the same. To put it in the words of Prof. Pigou, “In order to secure least aggregate sacrifice, taxes should be distributed that the marginal utility of the money paid in taxation is equal to all the taxpayers.” If the utility of the last dollar paid by A is less than that of the last dollar paid by B, the taxing of B, should reduce and that of A should increase. Such a process should continue till the marginal sacrifice for the last dollar of both A and B is the same.

Musgrave’s Views on the Principle of Maximum Social Advantage:

Now it is clear that Pigou and subsequently Dalton proposed two principles of budget policy. The first is that resources should be distributed among different public uses so as to equalize the marginal return of satisfaction for each type of outlay. The second is that public expenditures should be pushed to the point where the satisfaction lost from the last dollar taken in taxes and thereby, the marginal satisfaction derived in public and private sectors is equalized.

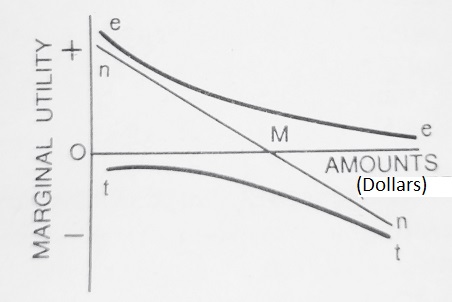

This approach is illustrated in the above diagram where the size of the budget is measured horizontally and marginal utility or disutility is measured vertically. However, Musgrave pursued the line of reasoning as advocated by Pigou and Dalton, but his treatment is based on the valuation of individual preferences.

Musgrave illustrated the principle in the following words- Suppose that the marginal utility of successive dollars of public expenditures, allocated optimally between public uses, is shown by line ee in the above figure and that the marginal disutility of taxes imposed so as to cause the least total sacrifice, is shown by tt, since the marginal utility of both public and private outlays declines with successive increments, both schedules fall from left to the right. The line nn is obtained by deducting tt from ee, and measuring the net benefits derived from successive additions to the public budget. The optimum size of the budget is determined at OM where marginal net benefits are zero. In this way, the minimum-sacrifice approach to the allocation of taxes is matched by a maximum-benefit approach to the determination of public expenditure, and the two are combined in a general theory of budget planning.

However, Prof. Musgrave himself admitted that there remains the fundamental difficulty of determining the preferences on which the values of the ee, and tt, schedules are to be based, and the further problem of choosing between alternative solutions. The mere principle of equal marginal benefit leaves us without a concrete standard by which the efficiency of various expenditure programmes can be determined, just as the mere principle of least total sacrifice leaves us without an operational means of allocating tax shares. In all, the “rules” of the figures given above offer little more than a pious remainder that the budget should be planned efficiently. If we are to determine ee and tt functions, the benefit from public services and the losses from the withdrawal of resources in private use must be valued and related to each other. These valuations must be derived from individual preferences, or we must postulate a social-utility function that is imposed in an authoritarian fashion. In a democratic country, the former approach must be taken.

How Maximum Social Advantage is Achieved:

Now it can be concluded that there are three fundamental principles of financial operations, which can help the State for achieving the objective of maximum social advantage.

- Public expenditure should be carried on up to the point where the benefit derived from the last unit of money spent by the State, is just equal to the sacrifice imposed in raising that unit of revenue.

- The resources of the State should be so distributed on different heads of expenditure that the marginal return of satisfaction from each of them is the same.

- The taxes should be so distributed that the marginal utility of the money paid in taxation is equal to all taxpayers.

Test of Social Advantage:

Prof. Dalton has suggested certain tests of social advantage, i.e., certain objectives which are to be achieved, which enhance the social advantage of the community as a whole, with the help of the operations of public finance. Following are the tests suggested by him.

(1) Preservation of the Community: The duty of every government should be to preserve the community against internal disorders and external attacks. Internal peace and external security create confidence and promote the economic life of the citizens and, thus enhance social advantage. It is, therefore, essential to maintain the army, police, judiciary, etc. to meet external and internal threats of the enemy successfully. In any case, it is the duty of the State to increase the welfare, both economic and non-economic, of its members. The State should follow a policy of peace and co-existence for home and abroad otherwise unproductive expenditure on the army, police, judiciary, etc., may have to be increased, and this may have an adverse effect on the economic life of the country.

(2) Improvement in Production: The second objective of the operations of public finance should be to increase the level of production, so that the economic welfare of the community may increase. Improvement in production implies-

- Increase in productive power, so that a larger product per worker shall be obtained with a small effort.

- Improvements in the organization of production, so as to reduce to a minimum the waste of economic resources through unemployment and other causes; and

- Improvement in the composition, or pattern of production so as to best serve the needs of the community.

Hence, the operations of public finance (Public expenditure, Taxation, Public debt, etc.) should aim at securing all these objectives, so as to increase the production and economic welfare of the community.

(3) Improvement in Distribution- The third consideration of State policy should be that what is produced should be properly distributed among the different groups of the community, i.e., it should reduce the inequalities and fluctuations of income of different individuals and families. This distribution of income should be in accordance with family needs as well as skills and effort. The inequalities of income, resulting due to unearned income, should not be tolerated while the skills and effort may be justified and suitably rewarded. To put it in the words of Dalton, “Improvement in distribution resolves themselves into-

- A reduction in the great inequality, which is found in most civilized communities, in the incomes of different individuals and families.

- A reduction in the great fluctuations between different periods of time, in the incomes of particular individuals and families, especially among the poor sections of the community.”

Hence the proper distribution of income and wealth is essential for increasing economic welfare.

(4) Stability and Full Employment- Public finance operations should also be aimed at stabilizing the level of economic activity and employment. To that end, during a period of inflation, the government should impose heavy taxes. During the period of depression, on the other hand, the volume of public expenditure should increase and taxes should decline.

(5) Provisions of the Future- Individuals give more importance to the present than to the future. And, therefore, their financial activities are guided to satisfy their present needs or needs of their lifetime. The State has double responsibility of looking after the interests of present generations as well as that of future generations. The State should therefore choose a great advantage for future generations than that a smaller advantage for the present. To put it in the words of Prof. Dalton, “The statesman is a trustee for the future, no less than for the present. Individuals die, but the community, of which they form part, lives on. The statesman, therefore, should prefer a larger social advantage in the future to a smaller one of today.”

Limitations:

The principle of maximum social advantage is the fundamental principle of public finance and it is supposed for granted to be the guiding principle of the State’s financial activity, yet there are certain limitations and difficulties in the way of the practical application of this principle.

In the first place, it is very difficult for the State to balance the marginal disutilities caused by the imposition of a tax with the marginal utility of public expenditure. Even an individual finds it difficult to do so often in his daily practical life when the disutility of the sacrifice equals the utility of his income. And, this difficulty is much greater for the State, because actual government spending and taxing are done by a larger number of public employees at different places and in different departments. Secondly, the State can speculate about the future and try to see the coming event, but it is very difficult to estimate on the basis of these speculations, that expenditure made by the public authorities will yield higher utilities than the disutilities caused at present. Hence, it is very difficult, if not quite impossible for the State to balance the marginal disutility of taxation with the marginal utility of expenditure. The success of the State is maximizing the net social advantage lies in her ability to correctly foresee all these results of her financial activities. And it requires a sensitive and intelligent mind to be able to do so. Thus, the government administration should be composed of planners, experts, and executors of high caliber at every level to get the maximum benefit out of the public expenditure incurred at a given time.

Comments (No)