Table of Contents

Taxable Capacity:

Taxable capacity refers to the maximum capacity that a country can contribute by way of taxation both in ordinary and extraordinary circumstances. Taxation Enquiry Commission defined it as, “Taxable capacity of different sections of the community may be said to refer the degree of taxation, broadly speaking, beyond which productive effort and efficiency as a whole begin to suffer.” Obviously, it is the capacity of the people as a whole and of different sections of the community to pay taxes, beyond which productive efforts and efficiency of production begin to suffer.

Prof. Musgrave, while defining the concept of taxable capacity said that the term taxable capacity invites bias. It limits the problem from the outset to the tax side of the budget while disregarding the expenditure side; by focusing attention on capacity; it suggests an upper limit to the size of public house hold that the private sector can stand while disregarding to the need for a lower limit without which a private sector cannot exist. Thus, according to Prof. Musgrave, the term taxable capacity refers to the sacrifice the community is able to sustain. Prof. Musgrave also defined the concept of taxable capacity in a different context that arises in determining the regional contribution to Federal finances, or the “fair” contribution of various countries to an international organization. Here the question is what sacrifice the community is able to sustain, a problem in the policy of the Distribution Branch transferred to an interregional or international plane. The greater the per capita and group incomes, the greater presumably, the ‘taxable or the ability to contribute.’

The taxable capacity of any country is not an absolute amount and one can only suggest symptoms that show that the taxable limit is being approached or the reverse. Precise limits are not capable of being measured with accuracy. Therefore, taxable capacity may be defined as the maximum amount which the citizens of a country can contribute towards the expenses of public authorities without having to undergo an unbearable strain. Sir Josiah Stamp described absolute taxable capacity as “the maximum amount, the citizens of a country could give towards public expenditure without having a really unhappy and downtrodden existence and without dislocating the economic organization too much.”

To put it in the words of Prof. Shirras, “Taxabale capacity is the limit of squeezability. It is the total surplus of production over the minimum of consumption required to produce that volume of production, the standard of living remaining intact.” Obviously, taxable capacity stands for the maximum amount which the people can contribute by way of taxes or it is the maximum amount that the state can get from the community by way of taxes, without dislocating the production. Though, Prof. Shirras, in his definition of taxable capacity, explained that minimum consumption includes a maximum of subsistence for the people, an amount for the replacement or an addition to capital for the purpose of industrial and commercial expansion. But, it is very difficult to estimate the amount required to meet the necessities of life and for the purpose of industrial and commercial expansion because, it is never static. Hence, the term minimum consumption is vague. Moreover, Prof. Shirras pointed out that the standard of living should remain unchanged but the objective should be to raise it. Besides, the effects of public expenditure and transfer payments are ignored.

Absolute and Relative Taxable Capacity:

The term taxable capacity refers in two senses:

- Absolute taxable capacity refers to a single community.

- Relative taxable capacity refers to two or more communities.

Absolute Taxable Capacity- Refers to the maximum amount that can be collected from a community without causing any unpleasant effects. If the operation of a tax system causes unpleasant effects, the absolute taxable capacity can be said to have been exceeded.

Relative Taxable Capacity- Refers to the taxable capacity of one community as compared to that of another. It refers to the proportion in which two or more Nations or States in a federation should contribute to the common expenditure through taxation. If one community is contributing more than its due share, in that case, its relative taxable capacity may be said to have been exceeded.

When the term taxable capacity is used, it always implies absolute taxable capacity.

Prof. Coline Clark pointed out that the maximum taxable capacity of most countries is 25% of the national income. It means that the safe upper limit of taxation is 25% of national production. It may have adverse effects on the desire to work and save of the people, if taxation exceeds more than 25% of the national income. But this may be true for developed countries rather than for underdeveloped countries. However, it can be concluded that the limit of taxable capacity is not absolute or fixed, but it may vary from time to time in the same country and from country to country at the same time.

Simon Kuznets defines the taxable capacity of government expenditures which may perhaps be approximated “by comparing the real product of the economic system with that part of it which is needed for the satisfaction of indispensable needs, exclusive of those rendered by the Government.”

Amotoz Morag relates taxable capacity to deficit financing and states that taxation will reach its limits when the marginal social costs of additional taxation exceed the cost of borrowing from banks.

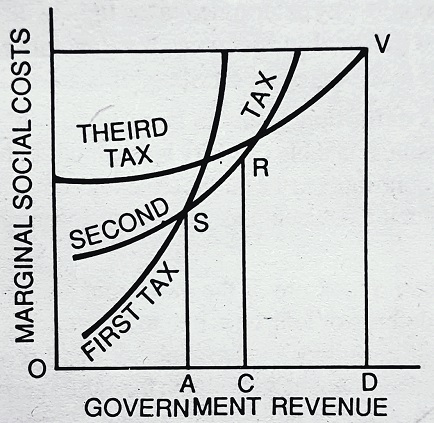

This can be explained with the diagram given below:

Here it is assumed that the marginal social cost of each tax at each level of government revenues is a function of the size of government revenues and would be the same, therefore, whether, all revenues up to that point were raised by this tax itself or by other taxes.

The first tax is the source of OA government revenues, the second of AC, and the third of CD, OD = VD, i.e. marginal social cost = Government Revenue. But when government expenditures necessitate a Revenue higher than OD, deficit financing has to be used to finance additional expenditure, since at the margin it is less costly. It means to use taxation to finance expenditures greater than OD would entail greater marginal social cost than tax revenue. Hence, deficit financing or other methods to raise revenue would be less costly.

It can be explained in this way also, the government will use the first tax exclusively as long as its needs for revenue do not exceed OA. After this stage an increase in expenditure will be financed simultaneously by both the first and second tax, equalizing the marginal cost of two taxes. The Third tax will be imposed when the revenue needs are higher than OA + AC, continuously applying the rule of equalizing marginal costs. If this OA + AC + CD is not sufficient, another tax will be introduced, and so on until the relatively efficient source of additional finance is not a tax at all as ordinarily defined.

One would start with the tax which has the lowest social costs and go on using it till its marginal cost begin to exceed those of another, then begin with that of the second tax and continue its use till its marginal social costs exceed those of third, and so on until all taxes have reached their capacity.

The concept of taxable capacity rests on the costs of taxations increase because of the income effect and announcement or allocation effect. But this approach does not quite tell us about the exact limit of taxation. The suitability of different modes of financing government expenditure is indicated.

Which definition is suitable: The point to which taxation and public expenditure can be carried and the distribution of the tax burden between individuals and groups, can not be theoretically determined in the light of the principle of Public Finance, it is a matter of political judgement. If a ‘taxable capacity’ is another name for the principle of least aggregate sacrifice, it is an illusion.

However, Stamp’s definition seems to be most suitable and practicable, according to which “absolute taxable capacity is the maximum amount which the citizens of a country can contribute to the public expenditure without having a really unhappy and downtrodden existence and without dislocating the economic organization too much.”

It is necessary to have a measure of the maximum amount of resources that can be raised to finance defense or long-term public investment. Tax-payers would have to be left with enough consumer goods to avoid serious discontent which would reduce efficiency. The balance would be available for public expenditure. This sum indicates absolute taxable capacity or taxable capacity. Suppose yt is real income and Emt is the minimum consumption expenditure, and T is an absolute capacity or taxable capacity.

| Then, T = yt – Emt |

Importance and Significance of Taxable Capacity:

The significance of the concept is as follows:

(1) The purpose of estimating taxable capacity may be to know how much money can be collected from the people to finance extraordinary expenditures like war.

(2) The knowledge of taxable capacity may be useful for the mobilization of economic resources for the purpose of economic development and planning.

(3) It may prevent a government from imposing unnecessary taxes which may have adverse effects on production and consumption.

(4) The concept may be useful for the purpose of comparison of the burden of taxation as between different States of a federal government.

(5) The concept may also be useful for the Central Governments, and hence, to develop the economy of the country as a whole in a balanced manner.

Factors Determining Taxable Capacity:

Limit of Taxable Capacity:

The limit of taxable capacity is said to have reached, when an account on the heaviness of taxation, consumption is curtailed and industry crippled, i.e., when consumption and production are adversely affected by the nature of taxation. The cost of collecting the revenue may be high and the additional taxation may not bring additional returns. It is sometimes argued that this limit is reached when taxpayers are compelled to sell their securities to pay taxes or they borrow from the banks. A gain when the limit of taxable capacity is said to have reached then the consumption of people does not rise in the same proportion as the national income increases. Similarly, if the national income decreases, the national consumption does not correspondingly diminish, and it thus leaves a smaller taxable surplus.

Measurement of Taxable Capacity:

Taxable capacity depends upon national dividends or national income. The national dividend has been defined by Marshall as, “the labor and capital of a country, acting on its natural resources, produce annually a certain net aggregate of commodities, material and immaterial including services of all kinds. This is the net Annual Income or Revenue of the Country or the National Dividend.” While Prof. Fisher defined it as a “National Dividend or income consists solely of services as received by ultimate consumers, whether from their material or from their human environments.” Prof. Pigou, following Marshall, defined it as, National dividend is that part of the objective income of a community including, of course, income derived from abroad, which can be measured in terms of money. There are several difficulties in the measurement of national income, which are very difficult to be removed if we follow Prof. Fisher or Prof. Pigou. Hence, Prof. Marshall’s concept of national dividend has been supposed for granted by most economists as the suitable one for the measurement of national income or for determining the taxable capacity of a country.

Thus, the “National dividend is, at once, the aggregate net product and the sole source of payment for all the agents of production within the country.” It means national income is the main source of income of every individual within the country. And, it is constituted by adding the income of every individual free from duplication, it is, “the totality of production free of duplication.” Obviously, for estimating taxable capacity we estimate national income free from duplication.

Methods of Estimating Taxable Capacity:

The following methods for estimating taxable capacity have been suggested by Prof. Shirras:

(a) The Personal or Aggregate Income Method: The method is based on the analysis of individual incomes based on income-tax returns, supplemented by statistics of death duties and other property taxes, i.e., the income of every individual is estimated and added. It means the income of the individual from various sources, i.e., from lands and buildings, profits from farming, income from employment, profits from the profession, and profits from trade, etc. are estimated and added to get the national income. If national income increases, the taxable capacity increase, other things being the same, and vice versa.

(b) The Production Method- In this method the net produce in terms of money from various sources is estimated and added up. It means that the net produce from agriculture, industry, and trade, etc., is estimated in terms of money and is added to get the national income. Taxable capacity directly depends on net production, i.e., if net production increases, taxable capacity also increases in the same proportion and vice versa.

There are several difficulties if only one method is followed. Suppose we follow the income method then it is difficult to estimate the income from agriculture because production and consumption simultaneously go into agriculture. Similarly, if we follow the production method, it is difficult to estimate the production of a vakil and a doctor.

Hence, it is suggested that both income and production methods should be followed, wherever each is suitable.

Comments (No)