Loanable Funds Theory of Interest:

This theory was originally propounded by the well-known Swedish economist, Knut Wicksell. It was further refined and polished by a group of Swedish economists, including Bertil Ohlin, Eric Lindahl, and Gunnar Myrdal. In Great Britain, the theory was developed by Sir Dennis Robertson.

As a matter of fact, the loanable funds theory represents a distinct improvement on the old, classical theory of interest because the term “supply of loanable funds” is wider in scope and includes not only saving out of current income but also bank credit, dishoarding, and disinvestment. It is clear that in the classical theory “saving” referred only to saving out of current income. It did not include bank credit, dishoarded wealth, or disinvested assets. Actually, as we know, bank credit represents important funds that are available to borrowers on payment of interest. Likewise, dishoarded wealth can also become available for purposes of investment. Disinvested wealth is another source of funds available to the borrowers.

Similarly, the term “the demand for loanable funds” is also wider in scope. According to the classical theory, the demand for saving depended only on investment, or the saving was demanded only for the purpose of investment. But, according to the loanable funds theory, the demand for funds arises not only from investment but also from the desire to hoard wealth.

We, thus, find that the loanable funds theory is wider in scope than the classical theory on both sides- on the demand as well as on the supply side. The classical theory considered the rate of interest as the function of saving and investment only, i.e., r = f (I, S) (r = rate of interest). The loanable funds theory, on the contrary, regarded the rate of interest as the function not only of saving and investment but also of bank credit (including dishoarded and disinvested wealth) on the supply side and of the desire to hoard on the demand side. Thus, according to the loanable funds theory (L. F. theory), the rate of interest is the function of four (not two) variables. r = f (I, S, M, L). M = bank credit (including dishoarded and disinvested wealth), L = the desire to hoard or the desire for liquidity.

The old, classical theory explained the interest rate in terms of real factors- real saving and real investment. It did not include monetary factors to explain the interest rate. Hence it was known as the real theory of interest. The loanable funds theory, on the contrary, explained the interest rate not only in terms of real but also monetary factors. Hence it is sometimes referred to as the real as well as the monetary theory of interest.

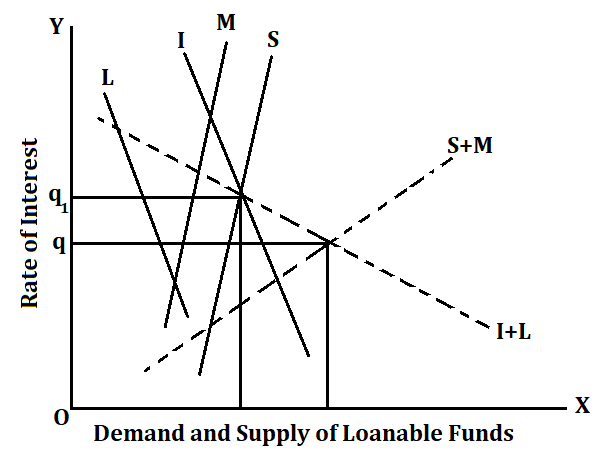

The loanable funds theory can be illustrated by means of a diagram as given below.

In the diagram, the M curve represents the supply of bank credit (including the dishoarded and disinvested wealth). The curve shows that the supply of bank credit is interest-elastic. It is influenced by changes in the rate of interest. The lower the rate of interest, the less the banks will be willing to create credit. The higher the rate of interest, the more the banks will be willing to create credit. There is, thus, a direct relationship between bank credit and the rate of interest. In the Wicksellian version of the theory, it was assumed that bank credit was not interest-elastic. In other words, bank credit was assumed to be non-responsive to changes in the interest rate. Wicksell believed that the bank credit was not affected by changes in the interest rate. Bank credit, according to him, depended upon the liquidity p[position of the banks, not on the rate of interest. So he represented bank credit by a vertical M curve parallel to OY. But now it is believed that bank credit is not interest-inelastic. So it is represented by an upward-sloping M curve as shown in the diagram.

The S curve represents the different amounts of savings available at different levels of the rate of interest. The relationship between the volume of savings and the rate of interest is direct. The higher the rate of interest, the higher shall be the volume of savings, and vice-versa. That is why the S curve slopes upwards to the right. The S+M curve represents the total supply of loanable funds available at different rates of interest. This curve has been obtained by combining together the S and M curves. S+M curve also upwards, because the higher the rate of interest, the higher shall be the supply of loanable funds.

On the demand side, curve I represents the investment demand for savings. The curve L represents the demand for idle cash balances or the desire to hoard money at different levels of the rate of interest. In the Wicksellian version of the theory, it was assumed that the demand for funds arose only from investment, not from the desire to hoard money. In other words, Wicksell assumed that people had no desire to hold idle cash balances or to hoard money. So it was not found necessary by him to construct the curve showing idle cash balances or liquidity preferences of the people. But now it is realized as a consequence of Keynes’ liquidity-preference theory of interest that people do hold idle cash balances with themselves. So a new curve showing the liquidity preference of the people (curve L in the diagram) has been added to the original Wicksellian version of the theory. The curve I+L has been obtained by combining together the I and L curves. The curve I+L represents the total demand for loanable funds at different rates of interest.

Thus, we have two consolidated curves now. The curve S+M represents the total supply of loanable funds. The curve I+L indicates the total demand for loanable funds. The market rate of interest is determined at the Oq level through the intersection of the S+M curve (total supply of loanable funds) and the I+L curve (total demand for loanable funds). At the Oq rate of interest, the aggregate supply of loanable funds is equal to the aggregate demand for loanable funds.

The diagram given above also serves to explain the difference between the classical theory and the loanable funds theory. While, according to the classical theory, the rate of interest is determined by the intersection of the I and S curves, according to the loanable funds theory the rate of interest is determined by the intersection of the S+M and I+L curves. In terms of this diagram, the rate of interest would be Oq1 according to the classical theory, while it would be Oq according to the loanable funds theory. In the loanable funds theory, money no longer plays a passive or neutral role. Its inclusion on the supply side brings the rate of interest down to Oq.

This diagram also serves to bring out the Wicksellian distinction between the natural rate of interest and the market rate of interest. Oq1 is the natural rate of interest, while Oq is the market rate of interest in this diagram. The natural rate of interest is that rate of interest at which savings is equal to investment. The market rate of interest is, on the contrary, that rate of interest at which the demand for loanable funds is equal to the supply of loanable funds.

The loanable funds theory represents an improvement over the classical theory. The loanable funds theory is more realistic than the classical theory. It marks an improvement over the classical theory in two respects. Firstly, on the supply side, the loanable funds theory takes into account bank credit (including dishoarded and disinvested wealth) which was overlooked by the classical theory. Secondly, on the demand side, the loanable funds theory recognizes the role of hoarding (or, liquidity-preference) as a factor influencing the demand for funds. The classical theory gave no place to hoarding or liquidity preference as a determinant of the demand for funds. The loanable funds theory is popular with American economists.

Comments (No)